Compare Do It Yourself Tax Prep vs Professional

A comment left by a friend of mine on the last post I did rejoicing that all my tax returns I’m responsible for were done gave me inspiration to write this post comparing do-it-yourself tax prep vs hiring a CPA or Tax Attorney to do it for you.

There are a number of reasons why people might be willing to pay the ever growing cost of hiring someone else to do their taxes, among them being:

- Don’t have time

- Won’t take the time

- Don’t think they know how

- Think it’s too hard

- Think my return is too complex

- Just want to write the check

- Want their tax return to be “right” and only a CPA or Tax Attorney is capable of that

Well, writing the check can be a nasty experience.

CPA’s Get Tax Returns Wrong Too

Back in the 80’s (1980’s kids, NOT 1880’s) when I was young I took my tax return and my brother’s to a CPA because we had invested in a partnership and had one of those God-awful things known as K-1’s.

Back in the 80’s (1980’s kids, NOT 1880’s) when I was young I took my tax return and my brother’s to a CPA because we had invested in a partnership and had one of those God-awful things known as K-1’s.

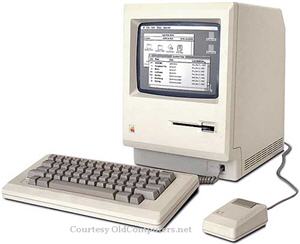

Each K-1 was identical, yet this whiz-kid CPA with this new fangled point & click device called a Macintosh ended up treating the entries on the K-1 differently on my tax return than on my brothers. The difference gave me a taxable income $400 higher than him and probably resulted in about $130 more in tax being paid.

For the privilege of getting at least one of our returns wrong (I think it was mine), he charged us $55 each, which seemed like a lot at the time. I sat in his office while he did them and it was less than an hour each (because that graphical screen Mac that looked just like the 1040 forms was soooo nifty!).

Fast Forward To Today’s Tax Returns

Well, today you can get the same sort of whiz-bang tax preparation on the computing device of your choice, even mobile platforms if you choose H&R Block online tax preparation.

I use the downloaded tax software for H&R Block, which is not that much less full featured than the expensive Intuit Lacerte software used by (most) CPA’s and Tax Attorneys.

Only these days, those guys will probably charge you $250 minimum (thankfully not much inflation, right?) and maybe much more depending on how complex your return.

Your Return, Your Money, Your Responsibility

So if you get your return back from the tax professional, and you get a refund or don’t owe more than you expect, do you just sign it and send it in? Or better yet, sign the authorization for your tax professional to electronically file it without even looking at it?

Let Me Tell You A Story About An $11,000 Error

While I mentioned in that last post that this year I actually upgraded to the H&R Block Premium and Business so I could do 1041 Trust returns, a member of our extended family thought it wise – and I did NOT disagree – to engage the services of a reputable tax attorney to close out the trust of an elderly deceased relative.

That relative was in the habit of over paying on tax estimates to always make sure enough was paid in so as not to “piss off” the IRS. You know, those friendly folks with SWAT teams at their disposal.

This person actually typed up a “cheat sheet” of relevant information to make sure the tax attorney did not miss important items like the excessive tax payments.

Now, this relative of mine is no tax preparation genius, and the tax return came back not owing much money so he almost just wrote the check. And while he had almost no understanding of the 1041 trust tax return he was able to figure out where to look for:

- Total tax

- Tax paid

- Amound due/refund

.. and he noticed that the tax attorney (who charged almost $1000 for his services) had neglected to input all of the payment information!

So a phone call later, a special round trip of 45 miles to the attorneys office – and another to pick up the corrected return a day later, and now, instead of owing a few bucks – was entitled to refunds from the state and federal governments of over $11,000!

an $11,000 mistake

by a reputable, highly recommended tax professional!

Here’s the kicker: do you know what the attorney said when this guy called to tell him of the error?

“That’s why we like to have the client look it over before we send it in.”

Seriously?

While I agree to have the client look it over, how many clients can see past the haze in front of their eyes when viewing a tax return, especially one (about 45 pages) as complex as a 1041 trust return? (Review the points above as to why the typical person hires the CPA or Tax Attorney to begin with.)

Government To The Rescue

Now, in reality, there is an excellent chance that both the state and federal government would catch the error and my relative would have gotten the refunds anyway, though maybe a little later than they will now.

But the point is still the same. Could he have done much worse than make an $11,000 error if he had bought the $75 software and done the tax return himself with a step-by-step interview – and – that version comes with the ability to call and talk to a real tax preparer for help, if I’m not mistaken?

And, saved the almost $1000 bill to the tax attorney, plus 3 trips…

Maybe Next Year You Should Try Do-It-Yourself Tax Preparation

It’s just a thought, but maybe you should try either the H&R Block online version or the tax software download version next time.

It’s a thought.

The link for H&R Block is here

Leave a Reply